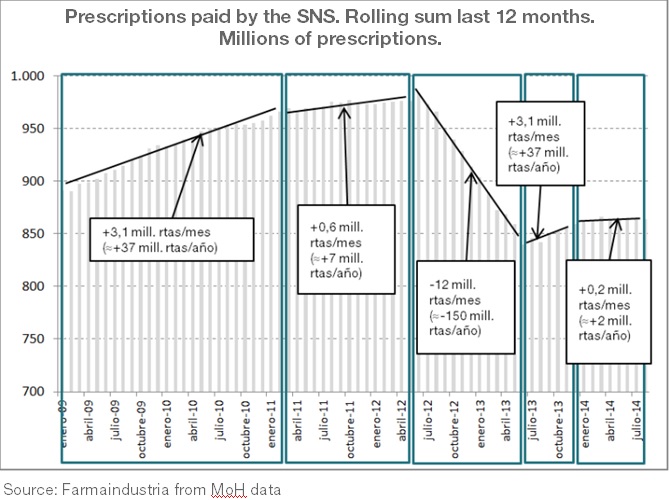

Madrid, November 13th 2014.– The demand of prescriptions in Spain has gone from a con-sumption close to 1,000 million prescriptions per year in 2012 to barely exceeding 850 million nowadays. This reduction in the number of dispensed prescriptions is due, mostly, to the amendment of the Spanish copayment scheme, which has had a contentious long term effect as far as growth on the demand of prescriptions is concerned. Please refer to number 113 of Farmaindustria‘s Economic Bulletin on the Pharmaceutical Market In Spain.

10 years prior to the introduction of the new copayment regime (between 2002 and 2011), pharmaceutical expenditure grew at an annual average pace of 3.8% caused mainly by an increase in the number of prescriptions of around 4.4% on average. To face this situation, which had also been affected by an important population growth, progressive ageing –amongst other factors-, one of the measures included in Royal Decree Law 16/2012 was an amendment of Spanish copayment scheme, which came into force in July 2012.

Thus, in the 12-month period which extends between the entry into force of this new copayment regime and June 2013, a decrease trend was experienced in the demand of prescriptions which registered 12 million prescriptions less per month. After surpassing the first 12 months of the new copayment system and after registering a temporary upturn for 6 months, prescription dispensing has now been stable since the beginning of 2014.

Fall in R&D investments

On the other hand, the Bulletin also remarks that, even though Spanish based pharmaceutical industry’s R&D investments maintain a certain inertia, the truth is that 2013 was the fourth con-secutive year in which a slight decrease was experienced; according to Farmaindustria’s internal survey on R&D activities undertaken by their Members for 2013, which can be downloaded in its Spanish version here.

Spanish based pharmaceutical companies invested 928 €M in R&D in 21013, which account for a 4.6% drop compared to the investments made the previous year. This decrease, added to the ones experienced in the three previous years is justified, to a greater extent, by the loss of incomes stemming from sales of pharmaceutical companies in Spain as a consequence of the legal measures implemented since 2010. In this regard, there is a strong correlation between the performances in the series of public pharmaceutical expenditure and pharmaceutical R&D investment.

The correlation between these series exceeds 90%, reaching 96 when you take into account one year of delays in R&D investments. These delays reflect the strong inertia born by R&D investments, given that normally, companies immersed in research programs continue their developments even when their income base falls in the short term. Nevertheless, if the latter becomes sustained, the adjustment is finally allocated to R&D investments.

Thus, the strong reduction of the Spanish pharmaceutical market during the last few years – alongside a lack of specific expectations of improvement- has proved that companies need to adjust their costs structures. In the case of R&D, the adjustment is more moderate in the short term, whereas it is more intense in the medium and long terms.

The Bulletin concludes by advising the importance of designing policies which allow for the creation of favorable environments and expectations in those industrial sectors which are more research intensive; policies which do not penalize their contribution in this area and that all its potential is suitably made the most of. It is worth highlighting that all of this is happening in a context where Spain is getting back onto a path of economic growth.

| We innovate for people

| We innovate for people