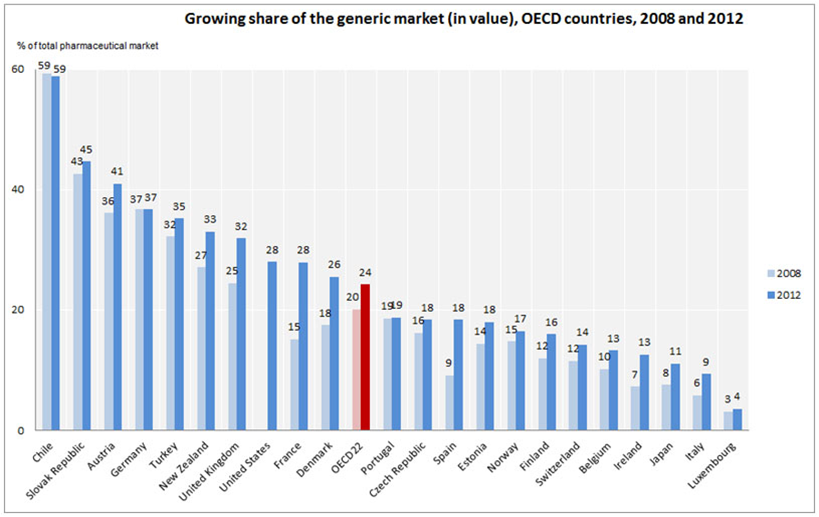

According to the recently released data by the OECD, Spain is the country with the highest rate -in growth of market share- of generic medicines during 2008 to 2012. More specifically, and as reflected in Farmaindustria’s 110th issue of the Economic Monthly Bulletin, during this period, the share actually doubled, going from 9% in 2008 to 18% in 2012; estimates actually predict this market share to be around 20% nowadays.

The Bulletin highlights that, in Spain, when speaking about a higher penetration of the market share of generic medicines, this is often mistakenly associated to a system with a greater capacity to generate pharmaceutical expenditure savings. However, the reality is that the ability to generate savings is linked to the share of medicines which are priced at a “generic level”, whether these are in fact generic products, or original brands that have lowered their prices to those levels of their corresponding generics.

It is worth mentioning that, in Spain, and as a consequence of the regulations on public financing of those medicines whose patents have expired, if a branded medicine is to maintain public reimbursement, said brand must lower its price to that level of the corresponding generic. This has effectively happened, and as mentioned in our Bulletin, almost 100% of the branded medicines that have generic competition have done so. Thus, in Spain, brands and their generics share the same price, so the possibility of generating savings does not depend on the generics market share itself, but it actually depends of the share of the market of medicines which are priced at “generic level”.

This landscape changes in other countries where generics and brands have different prices. In those cases, the higher penetration of the market share of generics could well be linked to a greater capacity to generate savings, as long as the prices for the latter would be lower than their branded competitors. In Spain, referring only to the generics market share entails ignoring the contribution to sustainability made by other products which are priced at the same level, even when they are not properly regarded as “generics” as such.

Comparing the market share of generic penetration in Spain with other surrounding countries, we found cases like the United Kingdom or Germany with shares noticeably larger (32% and 37% respectively), countries like Portugal and Norway with similar rates (19% and 17% respectively), and countries with much lower rates such as is the case of Belgium or Ireland (13% each), or Italy (9%).

Source: OECD Health Statistics 2014

Maintaining industry’s competitiveness, is essential for the EC

On the other hand, the Bulletin echoes a report from the European Commission about the pharmaceutical industry; this report was recently published endorsing the sector’s activity contributions to the continental economy. Similarly, the report depicts in detail the main contributions of the pharmaceutical industry to the European economy in terms of production, R&D, employment, productivity and support to the external sector. It also confirms that the pharmaceutical industry is one of the cornerstones of a knowledge based economy, and that it is essential to maintain its competitiveness.

On the contrary, the report acknowledges that the uncertainty of the market evolution, budgetary restrictions and the insecurity of the current framework are affecting the full development of its potential in a negative way. Thus, it singles out a series of factors which will limit the potential growth of this industry: public administrations’ budgetary restrictions, generalized pharmaceutical expenditure cost containment policies, the increase in pharmaceutical research costs, deficiencies in intellectual property protection regimes and foreign trade barriers to pharmaceutical products, amongst many others.

In this context, and taking into account these barriers the pharmaceutical industry faces, the European Commission has stated its commitment to foster and implement policies which incentivize the composition of a sustainable and competitive European pharmaceutical industry which allows the access of patients to the most innovative medicines.

| We innovate for people

| We innovate for people